Exactly how can late payments be removed from credit reports? That’s what we will be discussing in the following article.

Late payments are one of the biggest problems that can face a consumer in today’s economy. Late payments can prevent you from obtaining loans, credit cards, insurance, leasing a car, renting a home, or even getting a job.

Dealing with late payment issues is not easy; it requires patience, persistence and knowledge about how to navigate credit reporting procedures.

Knowledge is power, and we aim to empower you by providing the answer to the question, “Can late payments be removed from credit reports?”

What Is A Late Payment?

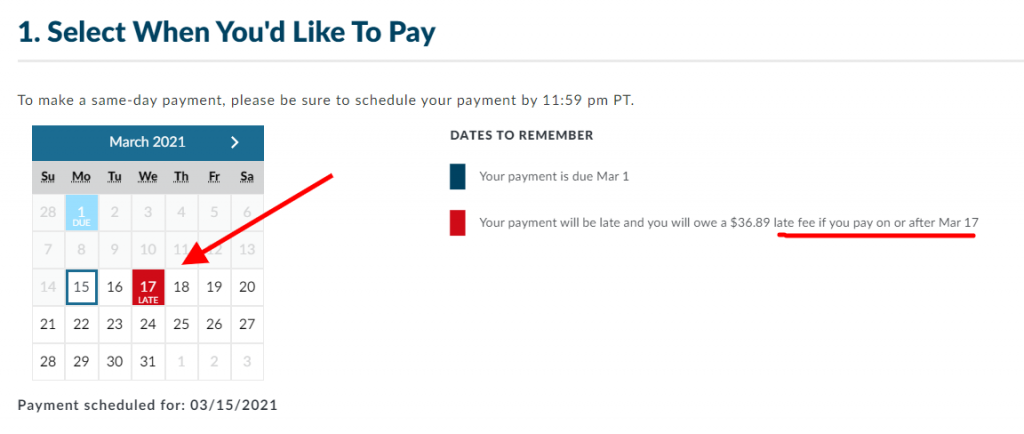

A late payment is a payment made more than 15-17 days (depending on your agreement) after the due date.

For example, if your mortgage is due on September 1st, then you’ll probably be assessed a late fee if you pay after the 15 or 17th (depending on your contract).

However, most creditors won’t report you late unless the payment is made after September 30th.

In other words, your payment must be made 30 days after the due date before a creditor reports it late to the credit reporting agencies.

The exception to this rule is that student loans generally don’t report a borrower late unless they’re behind 90 days or more.

How A Late Payment Affects Your Credit Scores

Lenders use credit scores to estimate a borrower’s creditworthiness. The lower the score, the greater the risk the borrower could default 90 days or more on their payment obligations.

Someone who misses a payment by 30 days is far more likely to fall behind 90 days. The result is a credit score drop of 100 points or more for a first time 30-day late payment.

60 and 90 day lates will have an even more severe effect on your scores. An account that goes more than 90 days late may results in the lender charging off the debt. Its much harder to remove a charge off than a late payment.

Late payments will stay on your credit for 7 years from the date of the event. However, the negative effect on your credit scores will lessen over time.

How To Prevent Late Payments From Reporting On Your Credit Report

Here are a few strategies to avoid the potential credit score decrease that comes with paying a debt 30 days or more past its due date.

- Monitor your credit report. Its not uncommon for creditors to mistakenly report someone late. Sign up for credit monitoring and regularly check your credit report for late payments. This will help you spot creditor errors as they occur, so you have time to correct them. You can also catch any payments you may have missed before they fall further behind.

- Pay off your credit card balances in full. You can only be late if you have a balance. Keep your balances at $0 and you won’t ever pay late.

- Set up auto bill pay. Every creditor offers some type of monthly auto withdrawal process. Alternatively, you could set up monthly electronic payments through your online bank account. Avoid missing payments when you are out of town or distracted by an emergency by scheduling regulare payments.

Avoid These 4 Late Payment Mistakes

No one wants to pay their bill late. Most of the time, bills are paid late due to financial challenges which couldn’t be avoided. However, sometimes bills are paid late because the consumer doesn’t know the rules of the game. Here are three of the most common slip ups to avoid.

- “I never got an Invoice” – You are responsible for payment regardless whether or not you received a bill/invoice. Your contract says you promise to pay. It doesn’t say they have to remind you. That’s just a courtesy.

- “I made a partial payment” – A lender will not credit you for a full payment until they receive the entire amount due. For example, let’s say your property taxes increased. This means your escrow will likely increase as well. The lender will hold your payment in an escrow account if you fail to send the higher payment amount due. While you might argue that you made your payment on time, they never actually deposited your payment because the full amount wasn’t received. Remember, they don’t have to send you an invoice with the new amount for the payment to be due.

- “I paid early”– Many people like to make extra payments each month to pay down their balances faster. If you pay 2x the invoice due, it doesn’t mean you don’t have to make your next payment. You have to check with your creditor as to how they handle extra payments. Find out if your payment will be applied to your principal balance or to your next payment due?

- “I didn’t know I had a payment due because I paid off the balance in full” AKA Watch out for the hidden Accrued Interest or Service Fee – In the event you pay off your balance in full, that doesn’t mean you don’t have a payment due. There may be accrued interest which doesn’t appear on your prior statement. Some creditors also have a monthly convenience or service fee which is due each month regardless of whether you have a balance or not. Always read your statements so you don’t miss your due date.

Can Late Payments Be Removed From Credit Reports?

If you do miss your payment, there may still be hope. Here is the answer to the question, “Can late payments be removed from credit reports.”

- Courtesy adjustment. Most lenders will give you a one-time courtesy adjustment. That means if you bring your balance current and ask them nicely, they may overlook the late payment just this one time. This usually only works if you’ve never been late before and you’re less than 60 days late.

- CARES Act – During the covid lockdown, many creditors extended forbearance and payment terms for their customers. If you suffered a financial hardship due to the covid crisis, then the CARES Act can help you to remove late payments which occurred during 2020.

- Re-aging of account – some creditors will allow you to re-age your account after a late payment. Re-aging is when a creditor reports your account from the date you started making your payments on time and no longer reports the old payment history with the late dates. This is normally done after 6 or more timely payments have been made. This is something more commonly offered by student loan providers.

- Disputing late payments. It’s a fact that both the credit bureaus and creditors make mistakes. Under the Fair Credit Reporting Act, you have the right to dispute credit report errors you believe to be inaccurate, unverifiable, or obsolete.

How to Remove Late Payments From Credit Reports

- Get a copy of your credit report. The best credit reports show how the creditor is reporting to each individual credit reporting agency. This may be helpful if it is reporting differently from one agency to the next.

- Gather your proof. Good examples of documentation you could use to show you paid on time include a canceled check, transaction number, or deposit receipt showing the date and amount you paid.

- Send a letter to the credit bureaus disputing the inaccurate information. Be sure to state which account, the account number, and which late dates you are disputing.

- If the dispute comes back verified by the creditor, then send a second dispute letter along with the proof you gathered.

- If the credit reporting agencies still fail to correct the error, then send all your proof by certified mail to your creditor directly.

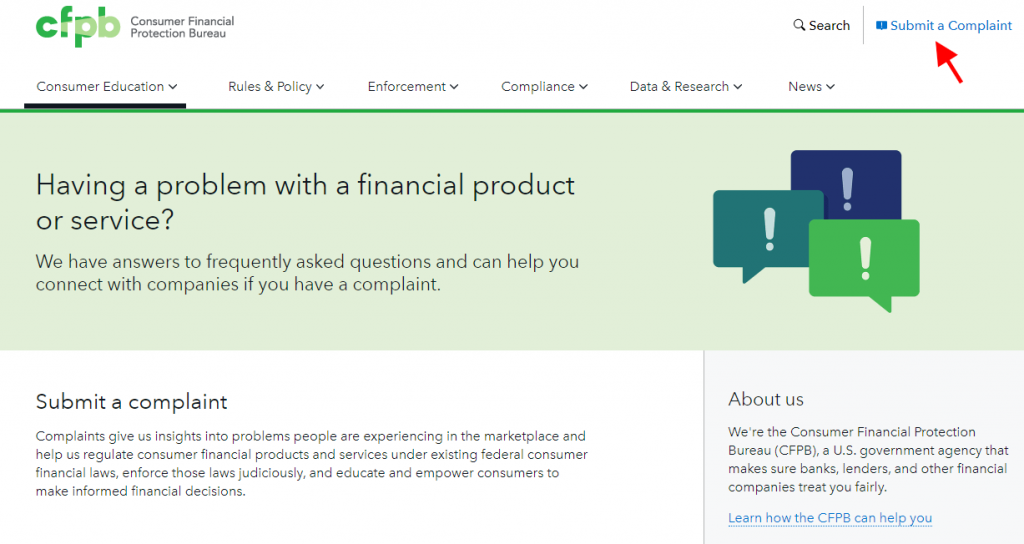

- If the creditor fails to correct the error, then file a complaint against both the creditor and credit reporting agencies with the CFPB.

Conclusion

Late payments will quickly lower your credit scores. Low credit scores will cost you money. You’ll pay more for loans and credit. You’ll have a hard time landing a great job or renting an apartment. Even your insurance will cost more.

In most cases you can remove late payments from credit reports. However, you can avoid the stress of removing a late payment by simply being proactive; set up auto payments and check your credit reports regularly.

And if you do miss a payment, bring the payment current as fast as you can, then reach out to the lender to see how they can help. The more time that passes, the harder it will be to remove that late payment.

1 Response to "Can Late Payments Be Removed From Credit Reports?"

[…] it is possible to ethically and legally remove any error from your credit report including late payments, collections, inquiries, charge offs, repossessions, foreclosure, and even […]