The credit system is a complete mystery for most Americans. How else could you explain questions like, “Do you want a high or low credit score?”. Or how about, “Why did the car dealer say my credit scores were different from Credit Karma?”

Its almost as if the banks and credit reporting agencies purposely want to keep everyone in the dark about how the credit system works.

The goal of this article is to help demystify credit scores, why lenders use them, and how they affect you.

What Are Credit Scores?

Credit scores are used to measure your creditworthiness. That basically means they help lenders decide whether or not to extend you credit such as loans and credit cards.

Before credit scores were created it was up to individual employees at the bank to decide if a potential borrower was a good credit risk using only what they knew about their payment reputation.

Can you imagine sitting across from a person you knew by reputation only and having to decide if your bank should loan them money or not based solely on your gut instinct?

Or looking at a stack of papers full of account information compiled from various lenders and using that to predict if the borrower in front of you was likely to pay it back or not?

And worse yet, your job depended on your being right most of the time!

This was obviously an imperfect process. Too many things could influence the final decision.

Two people could look at the same credit data and come to different conclusions about the perceived risk. Heck, the same person could have two different conclusions depending on their mood that day!

When it comes to measuring risk, or rally anything that may affect a bank’s profits, imperfect is unacceptable.

How Credit Scores Changed Lending Forever

The Fair Isaacs Corporation was the first to develop a statistically accurate mathematical formula for evaluating a borrower’s potential risk.

The result of their calculations was a number between 300-850 they called a FICO score. The FICO score is a numerical representation of the statically probability of a consumer defaulting 90-days or more.

This had a tremendous impact on the banking industry. Lenders could more accurately predict future profits and manage potential risk once they removed the human component from the credit evaluation process.

This also enabled lenders to extend their services nationwide, since they no longer needed to have personal knowledge of the potential borrower to make an educated credit decision.

Today FICO scores are still the most commonly used scores to make credit decisions, but they are not the only scores available.

The credit bureaus have developed their own scores called Vantage and more competitors are being developed each year.

How Credit Scores Are Calculated

Whether we’re talking about FICO scores, Vantage Scores, Sage Scores, or any other credit score model, the premise of the calculations works the same; the score model will look at payment history and past behavior to try to predict the future.

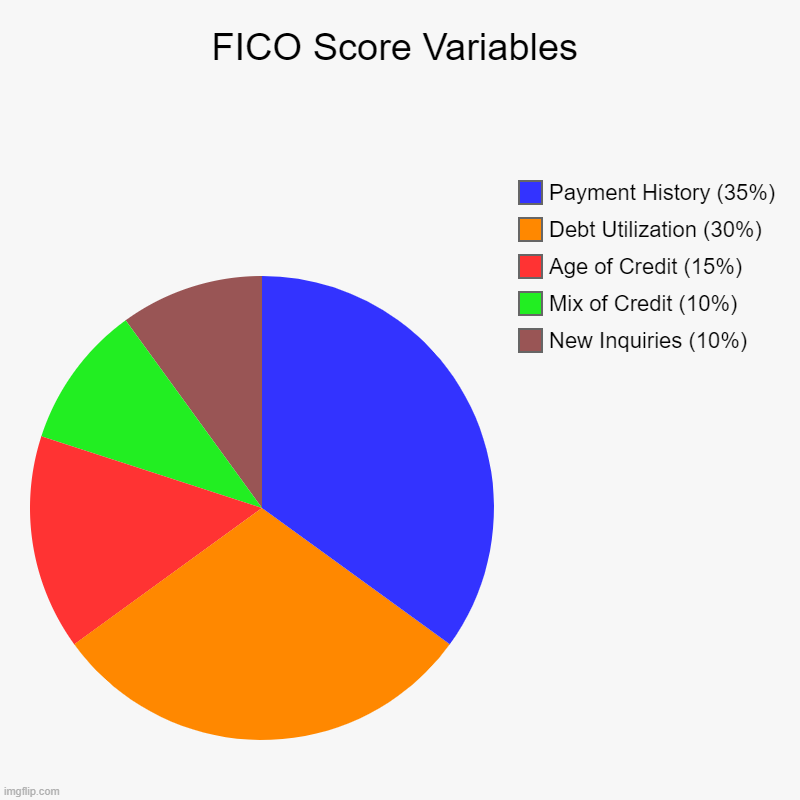

For example, the FICO score is determined by analyzing a consumer’s history and financial status using information in their credit report, specifically these 5 main areas:

- Payment history (35%) – Number, recency, and severity of missed payments over the past 7 years.

- Debt utilization (30%) – The percentage of your credit being used divided by overall credit available. This is calculated per account as well as overall.

- Mix of credit (15%) – The ratio of your credit cards to loans, as well as types of credit cards and loans.

- Age of credit (10%) – Older credit is preferred to new credit.

- New inquiries (10%) – The number of times your credit has been checked in relation to a credit application.

Odds Of Default By Score

First, keep in mind that the goal of a credit score is to determine whether or not a borrower will default 90 days or more.

FICO uses the score range of 300-850 to represent the level of risk to the lender. The higher the score, the less likely a borrower would be to default 90+ days.

Here are the statistical odds of default broken down by FICO score.

| Credit Score | Odds of Default |

| Above 800 | 1292 to 1 |

| 700 to 719 | 597 to 1 |

| 720 to 759 | 323 to 1 |

| 700 to 719 | 123 to 1 |

| 680 to 699 | 55 to 1 |

| 660 to 679 | 38 to 1 |

| 620 to 659 | 26 to 1 |

| 500 to 600 | 8 to 1 |

Why Lenders Charge More For Lower Scores

Let’s consider how risk affects how a lender charges fees for the following 2 borrowers. We’ll call them A and B.

A has never missed a payment. A would be considered a low risk for defaulting 90+ days, so let’s give A a FICO score of 740. The odds A will default are only 323 to 1. The lender’s risk is spread out over 323 people, so the increase to the fees needed for the lender to realize a return on their loan is minimal.

B has never missed a payment, but is carrying high credit card balances. B is more likely to fall behind due to the large monthly payments required. Let’s give B a FICO score of 680, due to the high balances. B’s odds of default are 55 to 1. The lender must charge enough interest to the 54 borrowers who don’t default to realize their intended profit.

Now, if just one of A’s credit cards is reported 30-days late, then A’s scores would likely drop 100 points or more instantly. A may now have a 620 score because A is statistically much more likely to fall behind 90 days.

A’s scores will gradually improve over time provided A doesn’t miss any more payments, because the odds of falling behind 90-days or more decreases with each timely payment.

The Benefits of A High Credit Score

Consumers with high credit scores enjoy the benefits of better interest rates, lower premiums on their car and home insurance policies, and more attractive loan terms.

In contrast, Americans with low credit scores may pay higher interest rates for loans and other financial products like mortgages and auto leases.

Many employers will review an applicant’s credit report, especially for financial positions. The idea is that a person who is responsible with their own finances can be trusted to give financial service or advice to their customers.

According to a study by Lendingtree, the average consumer could save $56,000 a year by improving their credit from a 669 to 740 due to more favorable interest rates on credit cards, loans, and insurance.

How to Get a High Credit Score

With so much money depending on good credit, here’s an easy to follow guide to obtaining a high credit score.

- Pay bills on time. Payment history accounts for 35% of FICO scores, so simply paying on time month to month will be the single best thing anyone can do to improve credit scores.

- Ask for regular credit limit increases. There are 2 ways to lower the debt utilization: Reduce balances or increase available credit. Requesting a credit limit increase every 8-12 months can help to improve and protect high credit scores.

- Add a variety of credit. A mix of bank credit cards, charge cards, retail cards, personal loans, student loan, auto loans, and mortgages is viewed as positive by lenders.

- Don’t close old accounts. The credit limits used to formulate debt utilization are only available from open accounts. A closed account removes the available credit from the equation. Any balances, however, are still included in the calculation. Try to keep your accounts open, especially if there is still a balance left.

- Check all 3 credit reports regularly for errors. According to a government accountability study, an estimated 20% of all consumer credit reports contained serious errors. Monitor all 3 reports to catch errors well before the application process begins to take advantage of the best terms available.

- Avoid applying for too many accounts in a short period of time. Too many new inquiries is a red flag as it signals to a lender that the borrower is in need of money. Limit new inquiries to once every 6 months.

How to Repair Credit Scores

If you ever notice your scores have taken a dip, then try some of these strategies for repairing your credit scores.

- Remove credit errors right away. The Fair Credit Reporting Act lays out the process for disputing credit errors. It is possible to dispute any information deemed to be inaccurate, obsolete, and/or unverifiable. You can dispute charge offs, late payment, collections, public records, and inquiries. You can Do-It Yourself or hire a professional.

- Use a personal loan to consolidate high interest rate revolving debt. Revolving debt from credit cards seems to be weighted much more heavily than installment (loan) debt. Using an installment loan to pay off high interest rate credit card debt will usually result in a significant credit score increase.

- Pay collections in exchange for deletion. Most collection agencies will remove the collection from your credit report in exchange for payment. Just make sure you ask them before you pay since asking after you pay is not likely to get you the same result.

- Pay down balances. Debt utilization (30% of score) is a percentage of how much of the available credit is being used. Keep balances under 10% of the available credit for optimal scores.

Conclusion

Credit reports and scores are used by lenders and employers when deciding whether or not you are a good credit risk. The information on your credit report can either open doors or cost you opportunities.

By understanding what makes up a good credit score and working towards improving yours, it may be possible to land that dream job, buy that dream house, drive that new car, and save more of your hard earned money.

4 replies to "Do You Want A High Or Low Credit Score?"

[…] stay on your credit for 7 years from the date of the event. However, the negative effect on your credit scores will lessen over […]

[…] difference is significant, since one effects your credit score and the other does […]

[…] score is to predict how likely a borrower is to default 90 days or more on a credit obligation. The lower the credit score, the more likely the borrower is to […]

[…] means the lower your credit score, the more you will pay in interest payments over the life of the […]