If you’re wondering, “How long does a hard inquiry last on credit?”, then chances are you recently checked your credit report and found more credit inquiries than you expected.

You’re right to be concerned. Running your credit too often can indicate that you’re in financial trouble and may not be able to get loans from other lenders.

This article will explain the difference in the types of inquiries you may see on your credit report, how they affect your ability to get approved for credit, and what steps you can take to protect your credit.

The Two Types Of Credit Inquiries

There are two types of credit checks which may appear on your credit report. They are referred to as hard and soft.

The difference is significant, since one effects your credit score and the other does not.

Hard

A hard inquiry is when a potential lender checks your credit score and reports when you apply for a loan or line of credit.

Hard inquiries last for up to two years though their effect on your credit scores only occurs during the first 12 months.

They only occur when you apply for credit such as a credit card, a credit limit increase, or a loan.

Soft

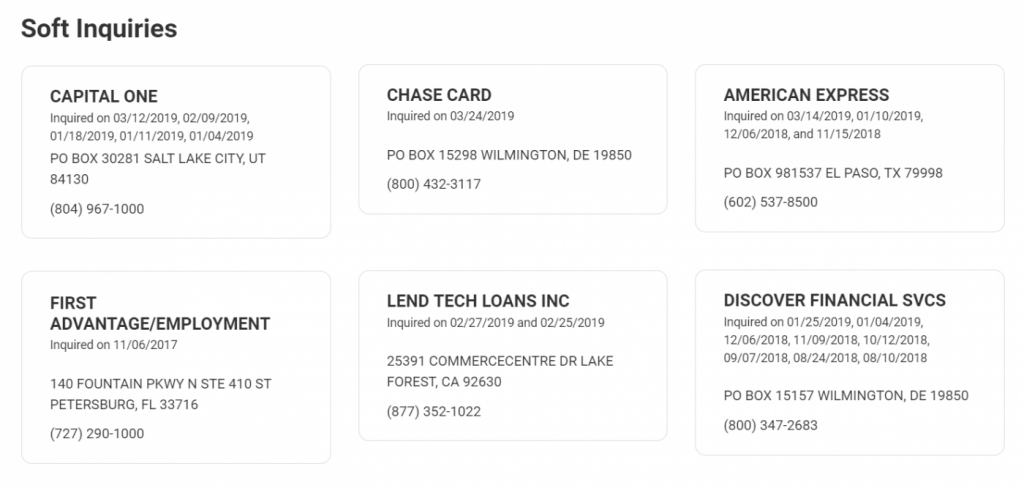

A soft inquiry is any inquiry made which is not related to a credit application you made. For example, here are some common examples:

- Checking your credit reports and scores online,

- An employer pulling your credit report when applying for a job

- A management company running your credit when you complete a rental application,

- Receiving an unsolicited “pre-qualified” letter in the mail

Let’s expand on the pre-qualified letter, since this may be confusing to some people.

Credit reporting agencies like Experian and Equifax sell consumer data to companies like Chase and Citibank.

That data can be filtered by various criteria like credit score, zip code, or total debt.

When Experian, for example, compiles a list of people in your zip code with XXX credit scores, then a soft inquiry is generated.

Even though the offer is credit related, you did not initiate it, so it’s still considered soft.

How Long Does A Hard Inquiry Last On Credit?

Since most lenders rely on your FICO scores for credit approval, we will focus on how they impact your FICO scores.

New inquiries account for up to 10% of your score. Since FICO uses a scoring range of 300-850, that means that hard inquiries may account for up to 55 points in total.

A hard inquiry will stay on your credit for up to 2 years, but it has little effect after the 1st year.

How Much Does A Hard Credit Check Effect Credit Scores?

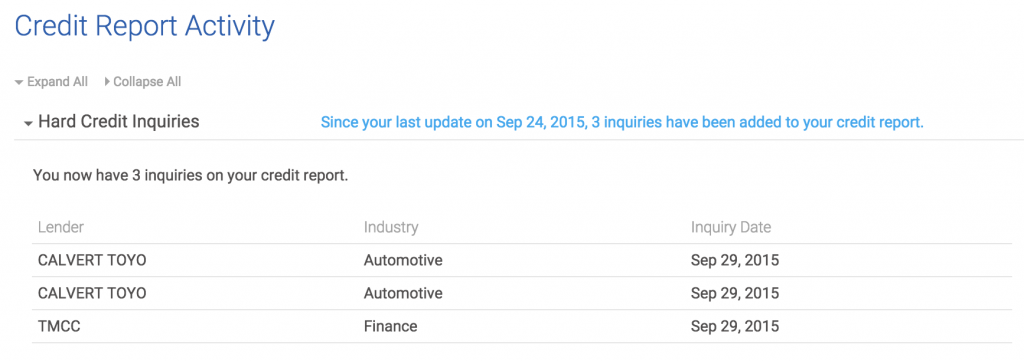

How much each new credit check impacts a score will vary. However, we ran an experiment to determine how many were needed to adversely impact someone’s credit score.

In our experiment, it took 11 inquiries within 1 month to reduce the subject’s score by 55 points.

This leads us to suggest a general guideline of 1 inquiry = 5 points, but this is only a guide and not a rule. There are many other factors which would effect the overall impact of each credit check. There are many cases in which adding an inquiry won’t adversely affect your credit score at all.

For example, an exception to this rule of thumb is when you’re shopping for a mortgage or auto loan. FICO understands that you need to shop for the best rate. They will typically lump all your mortgage or auto credit pulls generated over a 14 – 45 day period (depending on the FICO version) and treat them as one inquiry.

How Do Hard Inquiries Impact Credit Approval?

Lower credit scores are only one consequence of having too many inquiries.

Another consequence is the inability to get approved for certain credit or loans.

This can happen even if your scores are generally unaffected by the credit report requests.

For example, many credit card lenders will deny your application if you have more than 2 inquiries within the past 6 months.

The book, You’re Approved!, contains a guide that will help you understand the criteria lenders use when processing credit applications.

It lists how many and what type of inquiries will result in a denial, as well as other key factors.

How to Remove Hard Inquiries

It is possible to remove unauthorized hard inquiries. Any company that runs your credit report must have “permissible purpose”.

Permissible purpose is defined in Section 604 of the Fair Credit Reporting Act (FCRA). [15 U.S.C. § 1681b]

In short, permissible purpose means the institution has a legitimate business need for the information either

- in connection with a business transaction that is initiated by the consumer, or

- to review an account to determine whether the consumer continues to meet the terms of the account.

With this in mind, removing a hard inquiry is a function of determining whether or not the company who ran your credit can prove they had permissible purpose.

Here is a step-by-step plan:

- Obtain a copy of your credit report and check to see who ran your credit report. Highlight any you don’t recognize having authorized.

- Send each highlighted creditor a letter asking them to either provide you with their evidence of permissible purpose or withdraw the inquiry from your credit report.

- In the event the creditor doesn’t comply, then file a complaint with the CFPB

For a more detailed plan, please check out our post on deleting hard inquiries.

Note: Be very careful which creditors you contact, since any inquiries you dispute that had resulted in an open account will be immediately closed by the creditor.

How to Prevent Soft Inquiries

It is possible to prevent most soft credit pulls, too. You have the right to optout from marketing offers like the prequalification letters mentioned earlier.

- Visit the website www.optoutprescreen.com.

- Select the button to optin or optout at the bottom.

- Select optout for 5 years or optout permanently from the choices available.

- Submit your contact information and allow a few weeks for processing

Conclusion

While few things are as frustrating as seeing a long list of creditors who ran your credit, it’s good to know that they are not as damaging as they seem.

Follow this guide for managing your inquiries, so you can have confidence in those moments when you need to pull your credit to take advantage of the best terms available.

This is just one more resource you have at your disposal to save money and reach your financial goals.

1 Response to "How Long Does A Hard Inquiry Last On Credit?"

[…] Work at improving all 5 factors of your credit score to get it as high as it can go: Payment History, Debt Utilization, Age Of Credit, Mix Of Credit, And New Inquiries. […]