If you’re like most people, then when you think of how to boost your credit score, you automatically default to credit repair.

My definition of credit repair is removing inaccurate, obsolete, or unverifiable errors from your credit report. In other words, disputing payment history errors.

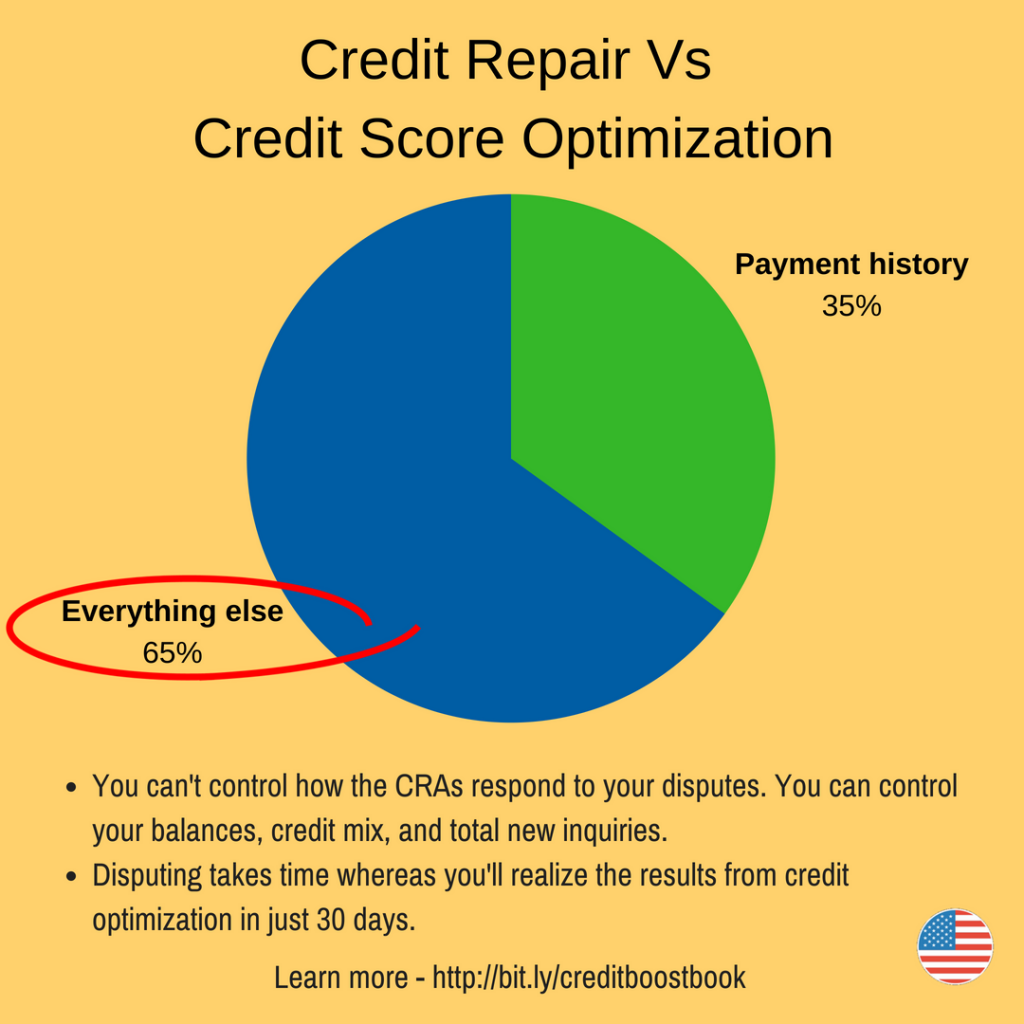

But the truth is that your payment history is only 35% of your credit score.

There is still another 65% available that you can optimize to boost your credit score.

This article will address how to boost your credit score fast using Credit Score Optimization.

Before we begin, let me first clarify the meaning of the title of this post.

Following these steps does not guarantee you will improve your credit scores 100 points.

There is more to credit scores than what these steps will cover. The remaining aspects of your credit score can effect your overall results.

In other words, if you follow all the steps, but then have a brand new collection appear on your credit report, then you will not see a significant credit score increase.

In addition, it is possible that you have already optimized the other 4 variables this article covers. If so, then following these steps won’t have a significant impact on your scores either.

That said, we have helped hundreds of people realize credit score improvements of 100 points and more, in as little as 30 days, following this process. Your results may vary.

Now let’s dig in…

Credit Repair Versus Credit Score Optimization

I refer to the strategic manipulation of the remaining 65% as Credit Score Optimization and it has many advantages over credit repair.

1. You can’t control how the bureaus respond to your disputes.

This makes credit repair very unreliable.

Even when you have documented proof, there is no guarantee that the bureaus will cooperate. That’s why they’re constantly in court.

However, you have much more control over your debt utilization, age of credit, mix of credit, and new inquiries.

The bureaus rarely, if ever, put up a fight when you want to update these areas of your report once you provide them with supporting documentation.

2. Disputing credit errors takes time.

By law, each dispute provides the bureaus with 30 days to investigate and respond.

Considering how unreliable they are when it comes to performing an investigation, it could take months for you to see a change.

On the other hand, you will see the effect of any change you document as to lower balances, new credit or loan accounts, or increased credit limits in as little as 30 days.

3. Credit repair is expensive.

The average person can expect to pay about $1000. Though its possible to dispute credit errors yourself, chances are you will get much better results, with far less stress, by hiring a professional.

I would compare it to fixing your own car. Yes, if you are really into cars and read books and watch shows on engine repair.. if you’re the type who does it for fun in your spare time… then you can fix your own car.

For most of us, the amount of time, money, and energy we would need to invest to learn about how motors work, finding the right tools, enduring the trial and error… it would be much easier to just hire someone to fix the darn car.

On the other hand, adding credit cards and loans to your report, paying down balances you need to pay anyway, requesting credit limit increases, and all the other strategies there are for Credit Score Optimization.. they’re all inexpensive in comparison.

4. Credit repair can be risky.

Let’s face it. There are a lot of credit repair scams out there. I see them on Facebook and Instagram all the time.

There are plenty of people who will take your money who have no business offering credit repair services.

Everyday people get ripped off by scammers just trying to repair their credit.

On the other hand, not many people lose their shirts by removing inquiries, or lowering their debt utilization.

I could go on, but you get the idea.

What Else Goes Into Your Credit Scores?

There are a total of 5 factors that determine your credit scores. This is what they are and how they break down.

- Debt utilization (30% of your score) is the second largest factor in determining your credit score.

It’s calculated as your debt balance divided by your total available credit. Its calculated not only as an overall average, but also by individual account.

- Age of credit (15% of your score) is the 3rd largest factor.

Its also calculated as an overall as well as on a per account basis.

- Mix of credit (10% of your score)

This is your ratio of credit cards to loans, as well as the variety of each.

- New Inquiries (10% of your score)

This is the number of new credit applications you’ve completed in the past 2 years.

How to Boost Your Credit Score By Optimizing The Other 65%

The heart of my strategy for how to boost your credit score 100 points in 30 days is about optimizing everything other than your payment history.

The first thing you will need to do is get a recent credit report. I recommend www.myscoreiqreport.com

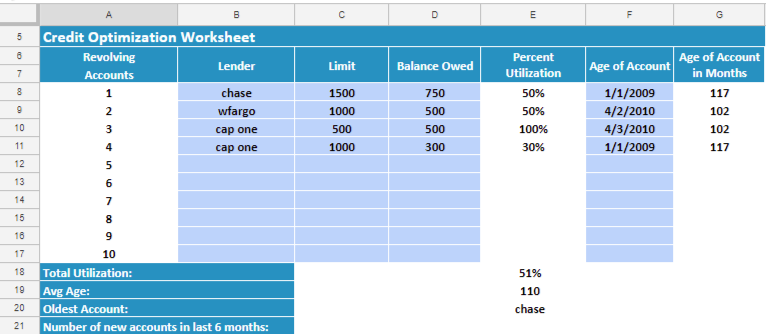

What I like to do is use a Google spreadsheet and map out each account by the creditor name, type of account (i.e. installment loans or revolving credit), date is was opened, credit limit, and the current balance.

You can hire someone on fiverr.com to add some formulas for you to help you determine your debt utilization and average age of account.

Here’s how to optimize each:

- Debt Utilization – You can improve your debt utilization by lowering your balances or increasing the amount of credit available.

- Age of credit – Older is better. You can increase your age of credit by becoming an authorized user on an older account. You should also make sure your date opened is reporting accurately on your credit reports. Contrary to popular belief, closing an account does not adversely affect your age of credit. I’ve made that mistake myself.

- Mix of credit – For best results you want to shoot for a balance of credit cards to loans, then mix up your variety. For example, 1 retail card like Target Red, 1 revolving bank card, and 1 charge card. A good mix of loans might include 1 auto loan, 1 mortgage, 1 student loan, and 1 personal loan.

- New Inquiries – The fewer the better.

The Complete Guide to Credit Score Optimization

This is a simplified example of how to boost your score without credit repair.

For a more detailed explanation and step-by-step guide, click here for my best selling book, How to Boost Your Credit Score 100+ Points in 30 Days Without Credit Repair.

For less than $10 you will learn every strategy I know for optimizing your credit scores without credit repair.

Its meant to be completed one short chapter/one day at a time. By the end of 30 days you’ve done everything possible to boost your credit scores.

Embed This Image On Your Site (copy code below):

2 replies to "How to Boost Your Credit Score 100+ Points in 30 Days"

Love it! “The other 65%”. Thank you for sharing your credit expertise, Brian.

[…] If you ever notice your scores have taken a dip, then try some of these strategies for repairing your credit scores. […]