If you want to learn how to delete credit inquiries, then chances are you looked at your credit report and saw inquiries that you didn’t recognize. This happens a lot more often than it should.

You’re right to be concerned, because unauthorized inquiries can lower your credit score and be an early signal of identity theft and other types of credit fraud.

Before I explain when and how to delete credit inquiries, let me first explain the different types of credit inquiries and how they effect your credit.

Soft Inquiries

A soft inquiry occurs are all the inquiries that appear on your report that are NOT in relation to a credit offer. These include:

- when you check your own credit through a third party service like *IdentityIQReport.com

- when an employer checks your credit in relation to a job interview

- when a lender obtains your credit information for the purposes of marketing

That last one needs a little clarification.

If Chase decided they wanted to send pre-approved offers to people with 700 credit scores in the New York City area, they would purchase that list from a company like Experian.

The inquiry would appear on your credit report as a soft inquiry because YOU did not fill out an application.

Hard Inquiries

A hard inquiry is one that is related to a credit offer. That means you filled out an application for a loan or credit card. That could also include any lender with which you have an account and were requesting a credit limit increase.

The reasoning behind this is that hard inquiries are an indicator or risk.

Your FICO score is meant to help lenders determine how likely you are to default 90 days or more on a credit obligation.

A consumer who is applying for credit cards and loans at a rapid pace is likely not a good risk for a lender.

The more inquiries, the bigger the risk.

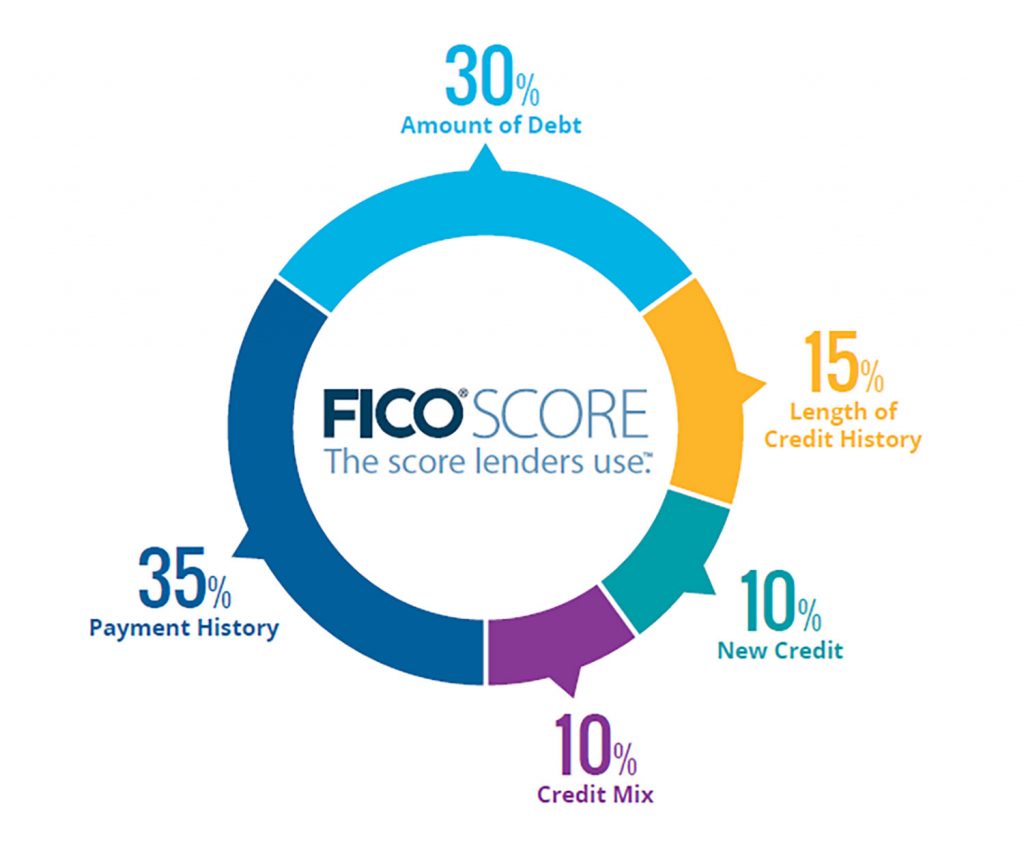

How Hard Inquiries Impact Your FICO Scores

New inquiries account for as much as 10% of your scores.

FICO scores range from 300-850, so 10% makes up as much as 55 points.

Inquiries only effect your scores for 2 years.

Generally speaking, you want to keep your inquiries low. I generally recommend no more than 2 inquiries every 6 months.

The exception to this is when applying for a home loan.

FICO understands that a home loan is a big investment. they get that you will need to shop around for the best rate, so they lump together all your mortgage inquiries made within a 45 day period as just one inquiry.

Defining “Permissible Purpose”

According to the Fair Credit Reporting Act (FCRA), which is the law that dictates how and when the credit bureaus may share your credit information, the only time a creditor or employer may obtain your credit report is when they have “Permissible Purpose”.

As per the FCRA, here are the conditions under which a credit bureau may provide your credit report to a third party:

- In response to a subpoena by a court with jurisdiction

- In accordance with the written instructions of the consumer

- To any person they believe intends to use the information:

- in relation to a credit transaction

- for employment purposes

- for insurance underwriting

- for licensing or other financial benefit

- by an investor to assess the risk liability of the person

- to review the current account of an existing customer to ensure they still meet the terms of the account

- In response to a request by the head of a State or local child support enforcement agency

- In situations of national security

Here’s Where It Gets Complicated

Let’s say you filled out an application to buy a car. Of course you know they’re going to pull your credit. What you may have not realized is in the fine print, you also authorized all of their lenders to pull your credit as well.

The next thing you know your credit report shows 12 inquiries for one application. Did you really authorize ALL of those inquiries?

Or how about when you default on a credit card. The lender then sells your account to a third party collection agency who then pulls your credit to find out your financial situation.

While you did authorize the original lender, did you really authorize the collection agency?

In the paperwork you signed accepting the credit card, it says they can assign those rights to a third party, but did you know that?

I would argue you didn’t.

And its under these types of circumstances that you may be able to delete your unauthorized credit inquiries.

How to Delete Credit Inquiries

- Get a recent copy of your credit report from a company like *IdentityIQReport.com

- Make a list of the creditors whose credit inquiries you want to remove. Your credit report should provide you with addresses.

- Send each creditor a certified letter asking them to remove the inquiry or provide proof they were authorized to pull it.

- In some cases a creditor may respond with proof. In those cases you should carefully review their evidence. If they authorization was vague, hidden deep within the legal document’s wording, or written in such a way that it was not easily understood, then you can argue that you weren’t aware of what you were signing. You can threaten to complain to your state’s Banking Commission, the FTC, and the attorney general.

- If the creditor fails to cooperate – Send a copy of the letter along with the USPS tracking receipt from the creditor disputes to the credit bureaus. Tell them you didn’t authorize the inquiry, the creditor failed to provide proof they had permissible purpose, and you want it removed immediately.

- If the credit bureaus fail to delete the inquiry, then contact us. We’ll put you in contact with one of our legal partners who specializes in FCRA violations.

The Bottom Line

Now that you know how to delete credit inquiries, you just need to keep an eye on your credit report.

New inquiries may be a sign that someone is using your name to obtain credit and loans.

Or else it could be a sign that a third party, like a collection agency, is investigating your finances.

At the very least, inquiries which lower your FICO scores could result in your overpaying interest for credit and loans.

You work hard for your money.

Don’t give it away to your creditors.

8 replies to "How to Delete Credit Inquiries"

[…] you believe your credit authorization was abused, then you can dispute the inquiry with both the lender and the credit […]

I reported this to Equifax and this is what they told me I had to do to dispute all the unauthorized inquiries. First I had to have a police report done and fax it to them within 5 days along with my driver’s license and who passed on my unauthorized permission to run my credit report to 6 other agencies. They really were unhelpful the guy’s English was horrible and I had to keep asking him to repeat himself and explain. how secure is faxing?

FAxing is very secure. It’s not a lot of credit repair services send disputes. The problem is getting through and not getting a busy signal. Try faxing in the AM hours.

[…] For a more detailed plan, please check out our post on deleting hard inquiries. […]

Need help on my transunion inquires i have a few questions not sure if you guys offer consultations but that would be very helpful.

Just sign up for a free consultation – https://uscreditadvocate.com/free-consultation

I have my letters all ready to send to the creditors but I included only my name and address. Should I send them a copy of my credit report? How will they know what account to delete?

You need to include the account number with your dispute.