If you want to learn how to dispute a repossession on your credit report, then read on.

What you’re about to learn is critical to your financial future. Here’s why…

You can’t hold a job without reliable transportation.

And you won’t be able to buy a new car if you have repossession on your credit. For most lenders, a repo is an automatic denial.

Considering that most credit repair professionals couldn’t tell you with any degree of confidence how to dispute a repossession on your credit report, this very advanced strategy could literally change your life.

Protecting Your Rights

The Fair Credit Reporting Act (FCRA) is the set of laws that governs how your credit information is collected and used.

According to the FCRA, the information reported about you must be accurate, timely, and verifiable.

If they can’t prove it, if it’s too old, or if its inaccurate, then they have to delete it.

The question you have to ask yourself is whether or not the repossession on your credit report is verifiable, accurate, or obsolete.

In our experience there are 3 situations where auto repossessions usually fail the test.

1. When An Auto Loan Isn’t A Loan

There are two ways that dealerships sell cars in the USA.

- Loan

- Credit Sale

Each transaction is very different and each has its own unique regulations. Let me explain…

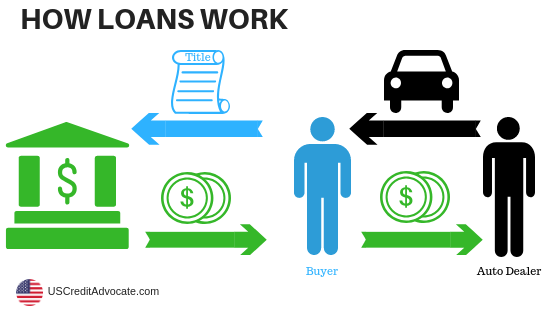

There are 2 parties in a loan: the lender and the borrower. The lender advances money to the borrower who grants security interest in the vehicle. A security agreement is the instrument that lays out the terms of the agreement.

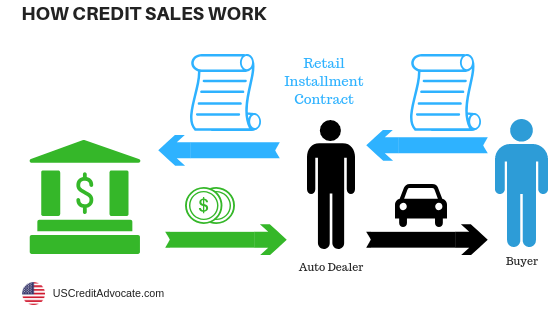

In a credit sale transaction, a credit seller transfers ownership of goods to a credit buyer in exchange for the credit buyer’s promise to pay for the goods over time.

This promise to pay is documented in a retail installment contract.

The retail installment contract is usually sold to a lender who pays cash up front at a discount and then takes over the position as the credit seller.

Approximately 80% of cars in the USA are financed through a Credit Sale, not a loan.

Even though the two transactions are clearly different, the credit bureaus treat them as one and the same.

2. Inaccurate Account Balances

When your car is repossessed, it is usually sold at auction to pay off the unpaid balance.

Most people cancel their car insurance as soon as the car is repossessed. The unused balance of your insurance is paid to the creditor and placed towards the unpaid balance.

Between the auction sale and the insurance refund, creditors rarely get the new balance right on the report.

3. Failure to Comply With UCC Article 9

When a creditor repossesses your car, they have certain duties including giving you back your personal stuff that was in the car, providing you with a “Notice of Sale”, and sending you a “Calculation of Deficiency or Surplus” upon request.

There are several areas in which a creditor can violate your rights here, but the most common one is to fail to provide you with “Calculation of Deficiency or Surplus” letter within 14 days of request.

Under UCC Article 9-616, a creditor who fails to provide the letter waives their rights to a deficiency.

How to Dispute A Repossession

Start by getting a copy of your credit report.

Personally, we recommend www.myscoreiqreport.com. This report provides you with FICO scores and the account data is laid out side by side so you can compare how it is reporting with each credit bureau. This makes spotting inconsistencies and violations much easier.

With report in hand you can request the credit bureaus perform an investigation on the grounds that you believe the information reported may be inaccurate.

Never dispute a repossession online.

Write a letter to each bureau and send it through the mail.

Once the bureau verify the creditor’s repossession data is accurate, then you can contact the creditor directly.

At a minimum, you’ll want to request the original contract and the “Calculation of Deficiency or Surplus” letter.

Look over the contract and determine if you have a security agreement or a retail installment contract. Dispute your auto loan if you have the latter.

Go through the “Calculation of Deficiency or Surplus” letter and ensure you were credited for any insurance refund, as well as any unearned interest after the sale of the vehicle. Dispute your balance if you find any inaccuracies.

Are Your Rights Being Violated?

We’ve covered just the most common violations when it comes to disputing a repossession.

There are thousands of other ways your rights may be violated, but covering them would fill a book.

Instead of investing of dollars and hours of your life exploring the very technical details of auto loan reporting, just click here to request a free consultation.

There is no cost or obligation to buy anything.

We’ll show you all the possible violations, explain what steps should be taken to dispute a repossession, and even connect you with one of our trusted legal partners if we believe you have a case.

Our legal partners work 100% on contingency. That means they only get paid if they win a settlement in your favor.

Click here to request a consultation now.

Embed This Image On Your Site (copy code below):

2 replies to "How to Dispute A Repossession On Your Credit Report"

IN 2015, WAS INCARCERATED, VEHICLE REPOSSESED AND SOLD. NEVER GOT ANY LETTERS SENT TO ME, OR MY VALUABLES THAT WERE IN VEHICLE WHEN REPO’D. NEVER GIVEN A COPY OF CAR SALE PAPERS , JUST TOLD AN AMOUNT THAT I WAS TO OR HAVE TO ACCEPT AS VALID. SANTANDER HAS HAD LAWSUITS INVOLVING THEIR LENDING PROCEDURES. I FIT WITHIN THOSE PARAMETERS AND AM BEING STONEWALLED AT THE GATE. THEY NEVER REACHED OUT OR EMAILED OR CONTACTED ME IN ANY WAY IN REF TO REPO. WHAT ARE MY STATUTES OF LIMITATIONS TO FILE AGAINST THEM FOR LOST PROPERTY AND INFORMATION BEING LEFT ON MY CREDIT REPORT. I HAVE ASKED THEM FOR LEGAL SALE DOCUMENTATION…THEY WONT PROVIDE. FILED DISPUTES ASKING FOR VALIDATED MONIES AND LEGALLY BINDING PPWK FOR SALE OF VEHICLE. NOTHING. CRA’S FILE DISPUTES AS “RESOLVED” YET I STILL HAVE NO LEGAL OR COURT VALID DOCUMENTS OF SALE AND THEY REFUSE TO PROVIDE THEM. THEY SEND IN A “BALANCE SHEET” TYPE LETTER TO CRA’S. NO LEGAL IN A COURT OF LAW DOCUMENTS… WHAT DO I DO NOW

I would recommend you speak with an attorney. You have a legal claim. I can’t give you legal advice.