Ever wonder how to get a charge off removed from credit reports? If so, then read on…

Let’s be realistic. It’s not only normal to have debt in this modern world, it’s practically mandatory. It’s almost impossible to buy a house, car, or pay for your college education without a loan…

And its almost impossible to qualify for a loan of that size without establishing credit first through the use of credit cards.

Despite our best intentions, sometimes people can’t pay back their debts on time.

A lender will eventually give up on the hope they’ll be able to collect on a debt. At that point they will write off the loss for bookkeeping purposes. The act of writing off a debt is also referred to as a charge off.

Collection Vs Charge Off

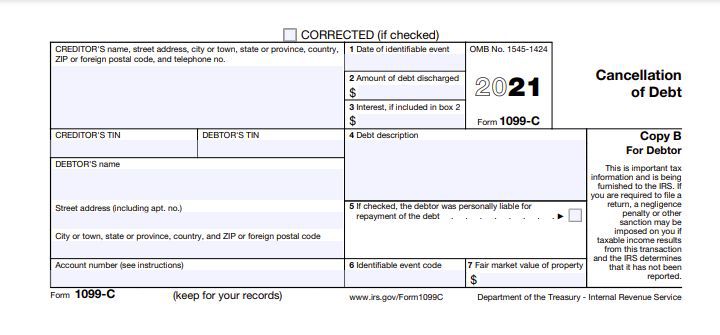

Charging off a debt doesn’t absolve you of paying the debt with one exception. If the creditor sends you a 1099-C, then you must claim the debt as income and pay taxes on it. If no 1099-C is sent then the debt is still active and you are still liable.

Some lenders have their own collection department and will continue collection efforts in house.

Some lenders outsource to a 3rd party collection service. The lender still owns the debt, but the collection agency acts on their behalf for a percentage of what is collected.

Lastly, many lenders prefer to sell their debts to collection agencies. The debt is sold for pennies on the dollar based on credit scores, age of debt, and dollar amount owed. The collection agency’s profit is whatever they can collect over and above what they paid for the debt.

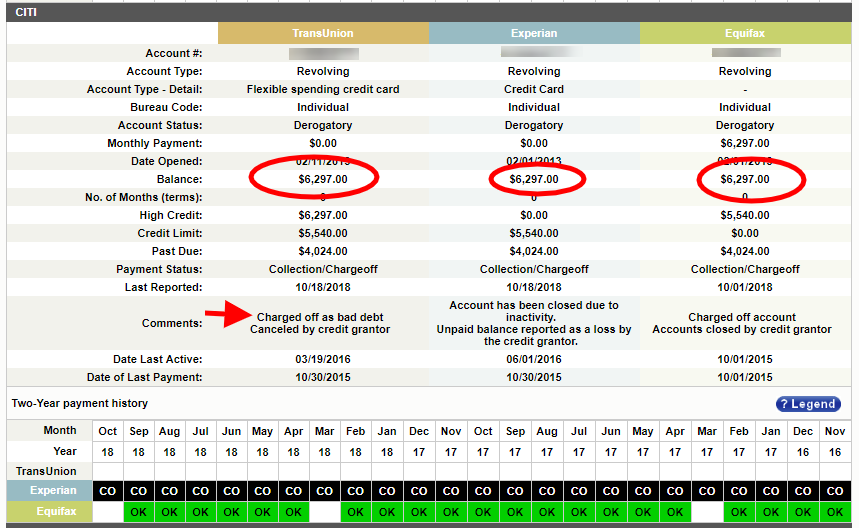

Your creditor will also probably report the charge off to the credit reporting agencies. If they sell the debt to a collection agency, then the collection agency may also report their new account to your credit file.

Once the debt is sold, the former owner of the debt should report $0 balance owed and the new debt owner will show the new debt due.

Its interesting to note that the code used to report a charge off or collection to the credit reporting agencies is exactly the same.

Since the codes for charge off and collection are the same, then the only real difference is who owns the debt.

We refer to the debt as a charge off if your lender still owns the debt. We refer to the debt as a collection if your debt was sold to a collection agency.

Each is approached differently from a credit repair perspective.

How A Charge Off Affects Your Credit Scores

The goal of a credit score is to predict the likelihood of your defaulting 90 days or more. In the world of credit scores anything 90 days late or worse is equally bad.

For example: 90 days late, 120 late, charge off, collection, repo, foreclosure… are all equally as damaging to your credit score.

Its important to note that its not the balance which is causing most of the damage to your score. Its the presence of the charge off that is doing the damage.

How to Prevent A Charge Off

An account in charge off status can be very difficult to remove. Take the following steps to improve your chances of avoiding them in the first place:

- Set up auto payments. The most common reason for late payments is human error. Set up auto payment through the creditor or your online bank account to remove the human factor.

- Monitor your credit reports – Creditors can make mistakes. Monitor your credit reports and catch errors early.

- Consider paying off high interest rate debt with a personal loan. If you find your balances are never coming down, then paying off cc debt with a loan is a good option. It will boost your credit scores and force you to pay off the balance over a predetermined time frame.

- Contact the creditor and work out payment terms if you foresee financial hardships coming. You can ask the creditor to freeze your interest rate and provide you with a new payment plan to keep you on budget until the hardship passes. The key thing is to keep communications open and let your creditor know what is going on.

- Don’t fall behind for more than 90 days. If you do miss a payment, catch up as quickly as you can. Most lenders won’t consider a debt a lost cause until it’s over 90-days past due.

How To Get A Charge Off Removed From Your Credit Report

Simply paying the past due amount will not remove the charge off from your credit report. I have never seen a creditor delete a charge off in exchange for payment.

In many cases, paying will not even immediately improve your credit score either. Remember, its not the balance that is causing the bulk of the damage to your credit score. Its the presence of the charge off that is keeping you from finding out how high your credit score can get.

Follow these steps to remove a charge off from a credit report:

- Get a copy of your credit report. Grab a highlighter and highlight the charged off account.

- Verify who owns the debt. The process for disputing or negotiating is different for a creditor than a collection agency.

- If you believe the charge off is reporting in error, then read this in depth post about disputing a charge off on your credit report. Our process hinges on proving your rights have been violated.

- If you have the funds, consider settling the debt. Start at 25% so you have room to negotiate. Ask if they will delete the charge off or entire account in exchange for payment. If they agree, get it in writing if possible.

Conclusion

A charge off signals to lenders that you are a high risk. The greater the risk, the more you will have to pay for credit and loans.

It can be very difficult to remove a charge off from credit reports. Your best option is to try to prevent it from happening.

Should you find yourself facing a financial hardship, then communicate with your lender. They may be able to help you work out a repayment program that helps you get back on your feet faster than might otherwise be possible.